New working paper on ‘Unconventional Monetary Policy’

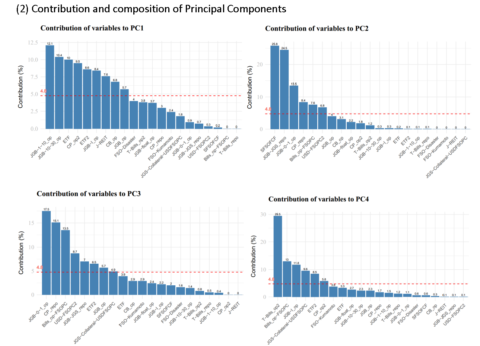

A new working paper, co-authored by Senior Research Fellow Markus Heckel and Kiyohiko G. Nishimura (Graduate Institute for Policy Studies GRIPS/Center for Advanced Research in Finance CARF, University of Tokyo) examines the unconventional monetary policies of the Bank of Japan from 2002 to 2019 with a focus on open market operations. The CARF working paper Unconventional Monetary Policy through Open Market Operations: A Principal Component Analysis applies a principal component analysis to investigate the complexity of the operations. The authors find that four principal components (PCs) explain most of the variance of the Bank of Japan’s operations of various facilities and measures. They also observe that open market operations of the Shirakawa era (2008-2013) were the most complex, resulting in an increased number of PCs. In contrast, the corresponding number in the other eras has been at most two (Fukui, 2003-2008) and four (Kuroda, 2013-present). This paper is a result of Markus’ research project Economic Discourses of Monetary Policy – The Case of the Bank of Japan.